Selling insurance in Kenya has been seen as the hardest, non prestigious and lowly job that one can do. 6 years ago when i joined the insurance industry i was told i had joined the profession of thugs. It was mostly seen as a profession of the uneducated , even the existing agents did not think graduates were fit for the job, they felt that these “educated” people should get better jobs and leave the “uneducated” to sell insurance, i remember when i joined Britam, one of the agents told me ” hii kazi iko na wenyewe” meaning the job is not for the graduates/ educated.

This is also true for the so called “educated”, people leave university to look for jobs that they were promised when they chose the so called ” marketable courses” just to discover those jobs do not exist. Since the courses are marketable, everybody is doing them and by the time you clear college the market is all taken. It is no wonder we keep asking, serikali itusaidie ( government should help us) we complain that the government is doing nothing to create jobs and therefore we have so many depressed graduates and others who are doing jobs that they don’t like because they just want to make ends meet. I believe educated people should be providing solutions to the market and not becoming problems to the society. It is unfortunate that our colleges and universities are preparing people to be employed instead of preparing employers. The colleges and universities have become industries that are producing products just like any other manufacturing industry instead of being facilitators of thinking, where products and services that are suitable to solve our society problems are produced. Anyway too much about our education system, lets look at selling insurance.

I look at selling insurance as the easiest way to start a business. This is because it is not a capital intensive business, i use the word capital to mean Money. You only need some few coins to keep you mobile ( transport), airtime and passion. So what makes a successful sales agent?

- Trust: you need to realise that people buy from people they like and trust, your clients must see you as a trusted advisor, one who educates them on the benefits of insurance. one who is honest to sell a product that will pay less commission because you have analysed and you know that is what the client needs. you must keep the clients needs first before your own commission. But how do you know what the client needs? many people say and think selling is about talking more, the best sales people listen more. selling is about providing solutions, but how can you provide solutions if you do not understand in advance what the pain points are? you must listen to the client in order to understand their needs. How do you listen? you listen by asking. learn to ask the right questions and you will identify your clients needs. when you listen, clients feel that you empathise with them and you care about them and not just that sale.

- High energy levels: when i was in physics class we were told that energy is neither created nor destroyed. energy is transferred from one object to another. I would say Selling is transfer of emotional energy from one person to another. As a sales person you need to have high emotional and intellectual energy levels. For those who have been selling, you must have had a situation where you feel low and bored, the moment you make a call to the prospect they either do not pick your call or they decline to give you an appointment. Selling insurance is not like selling clothes or handbags whereby if you make sure you have the best brand at an affordable price you can simply sit and it sells itself. In insurance you are selling a promise, you need to have a why? you do it, if you understand why? you will be so excited to sell such that your clients can feel the energy. It is important to sit down a examine the motivation behind your selling insurance because the job in itself is draining and you need an internal motivation. when i started selling i had to define why i was in the insurance business and this is what kept me going even when the external forces were pushing me to give up. People want to associate with people who are motivated.

- Wide range of product knowledge: Remember you are a solution provider, how can you be providing only one insurance solution? what if you are selling life insurance and you meet a client who needs a medical insurance? somebody said, if you were to work with a hammer, everything else looks like a nail. You need to have a bouquet of products such that you meet all your clients insurance needs otherwise your clients will always be other peoples prospects. You will sell life insurance to a client, and another person is prospecting them for a medical cover. The danger is, if the agent who sold the medical cover is more likeable by the client, you will simply loose the client. You should be like mother hen, keep all your chicks together. Most of the people who have been selling life for many years need to understand that the client of today is different from the one you sold to 10 years ago, they are more sophisticated and more knowledgeable. Wake up and smell the coffee, else you will find yourself so beautifully equipped to deal with a world that does not exist.

- Technical knowledge: Most of the agents in Kenya only know how to sell a policy. You need to have a basic understanding of the tax and legal aspects of your products. For example, when someone buys a life insurance, they are entitled to a 15% tax relief, if they buys a retirement scheme, they are entitled to a tax exemption etc. You also need to understand the implication/effect of the product you are selling to your clients overall financial objective. I tell my colleagues that i do not sell insurance, i only facilitate people to plan for their finances and manage their risks.

- Leverage on technology: I know this may be difficult especially for those the technology found, i mean those who were born before the mobile phones and the social media. It is said that Kenya is among the top most active countries on social media. There is a particular clientèle who have high disposable income and need insurance that you may never meet face to face, simply because they do not see why people need to meet to transact business. of course i understand that the insurance companies must do something about the strict rules of having an original application forms signed and many other rules that have been overtaken by events. I honestly dont understand why an agent have to travel 300 kms to close a life insurance. again i say, insurance companies need to smell the coffee, wake up and generate transformational products and processes that meet the needs of our clients.

And i conclude today’s discussion by saying what Gary Blair said, its no longer the big that eat the small but the fast that eat the slow. Speed is the only competitive advantage that any insurance agent or company has.

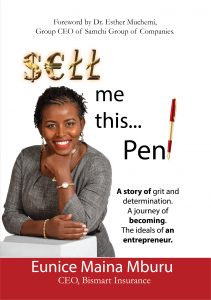

Photo by Free Digital Photos