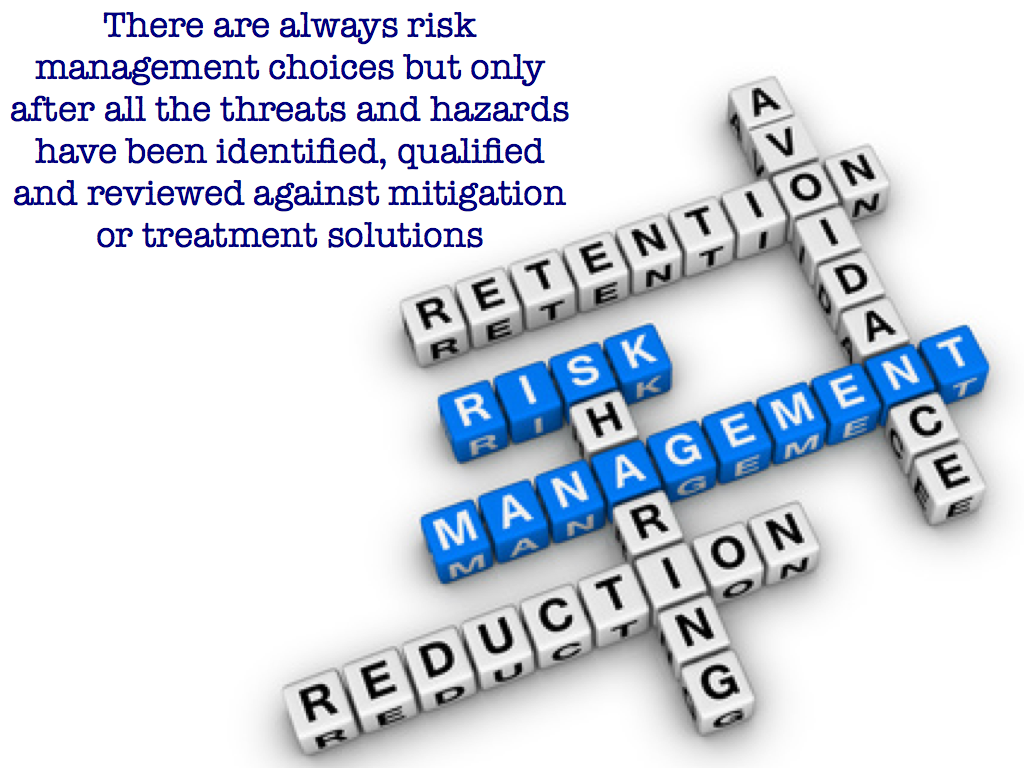

Risk management refers to the practice of identifying potential risks in advance, analyzing them and taking precautionary steps to reduce/curb the risk.

Definition: In the world of finance, risk management refers to the practice of identifying potential risks in advance, analyzing them and taking precautionary steps to reduce/curb the risk.

Description: When an entity makes an investment decision, it exposes itself to a number of financial risks. The quantum of such risks depends on the type of financial instrument. These financial risks might be in the form of high inflation, volatility in capital markets, recession, bankruptcy, etc.

So, in order to minimize and control the exposure of investment to such risks, fund managers and investors practice risk management. Not giving due importance to risk management while making investment decisions might wreak havoc on investment in times of financial turmoil in an economy. Different levels of risk come attached with different categories of asset classes.

For example, a fixed deposit is considered a less risky investment. On the other hand, investment in equity is considered a risky venture. While practicing risk management, equity investors and fund managers tend to diversify their portfolio so as to minimize the exposure to risk.